News

[Real Estate Crowdfunding Platform Rimawari-kun] Applications for Higashi-Kanagawa Income Property Fund Open on Tuesday, August 13, 2024, with an Exclusive Investor Campaign Available!

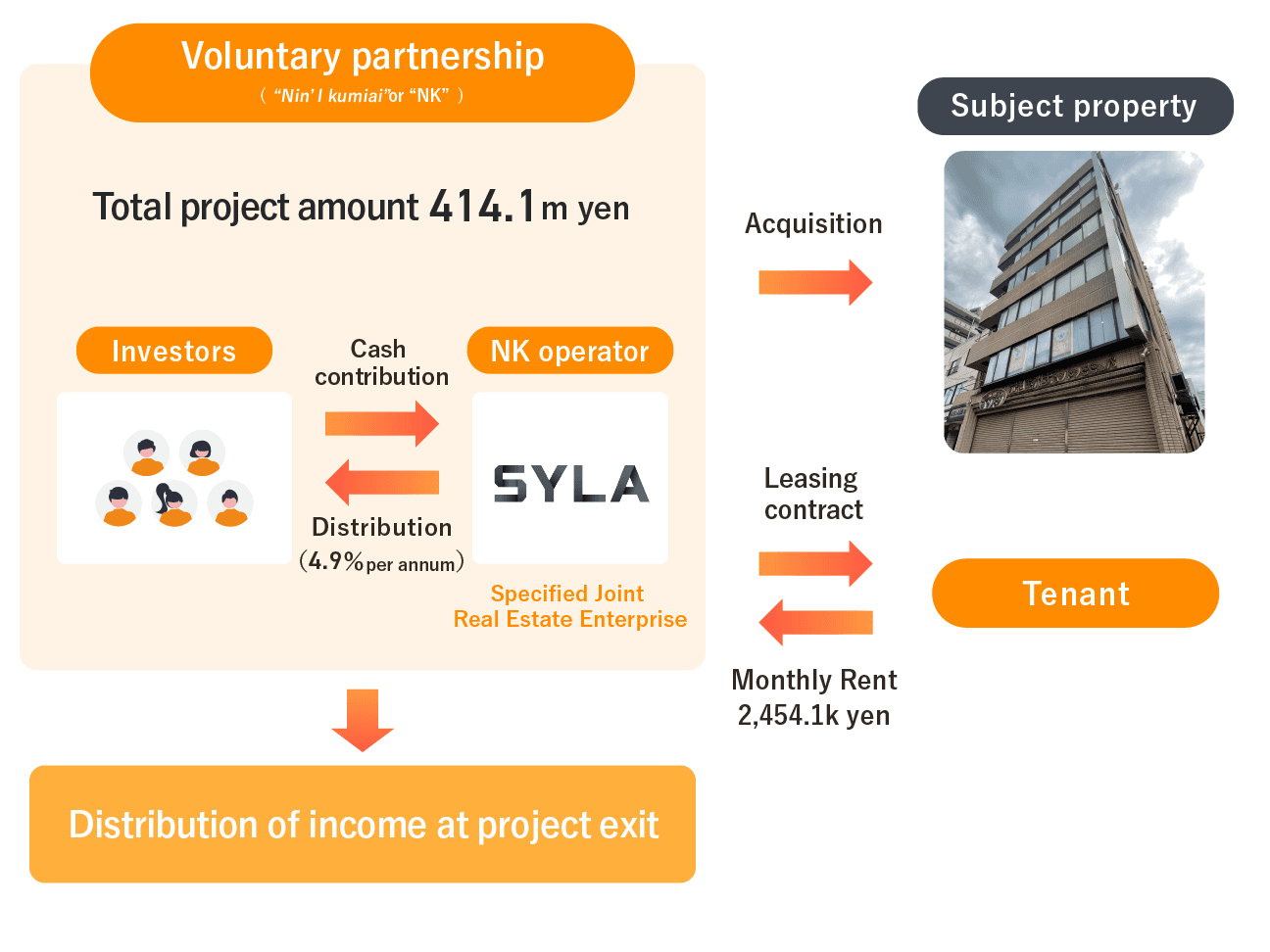

SYLA Co., Ltd. (Head office: Shibuya-ku, Tokyo; CEO: Yoshiyuki Yuto), a wholly owned subsidiary of SYLA Technologies Co., Ltd. (Head office: Shibuya-ku, Tokyo; CEO: Hiroyuki Sugimoto; NASDAQ: “SYT”), will open applications for Higashi Kanagawa Income Property Fund on Tuesday, August 13, 2024. The offering amount is 414.1 million yen, with expected yield of 4.9%.

Higashi-Kanagawa Income Property Fund

https://rimawarikun.com/customers/products/106

Features of the Fund

Rimawari-kun is a "supportive" real estate crowdfunding platform designed with the concept of "support in a new form." It allows individuals to invest in real estate that contributes to society, revitalization of local communities, and supports someone’s dreams and challenges.

As prices continue to rise, Rimawari-kun has launched a new fund to assist members with asset management. Amidst the inflation, relying solely on savings is not sufficient to cope with the risk of declining assets. The Rimawari-kun fund supports your asset management and growth!

About the Higashi-Kanagawa Area

The property is situated in the Higashi-Kanagawa area, near the heart of Yokohama City. This densely populated region in Kanagawa Prefecture is served by both JR and Keikyu lines, offering convenient access to Yokohama in approximately 3 minutes without transfers, and to central Tokyo areas like Shibuya and Shinjuku in about 43 minutes with only one transfer. The Keikyu Line's Airport Express also stops here, providing direct access to Haneda Airport.

The area around the JR station offers large commercial facilities and a variety of restaurants, ensuring daily shopping convenience. With lower rents than Yokohama, Higashi-Kanagawa is a popular choice for those who prefer Yokohama but seek more affordable options. Consequently, there is ample demand for both residential and commercial properties in this area.

Exclusive Campaign for Investors

Investors in this fund will receive a Rakuten Points gift worth up to 1% of their investment amount! Please check the fund page for more details.

Fund Overview

Fund Name: Higashi-Kanagawa Income Property Fund

Offering amount: 414,100,000 yen

Expected yield: 4.9%

Time for distribution: Every 6 months

Fund management period: 1 year

Type of application: First-come basis

Term of application: 20:00, Tuesday, August 13, 2024 - 12:00, Tuesday, August 20, 2024*

Website for application:https://rimawarikun.com/customers/products/106

*Applications may be closed early or extended depending on the number of applications received.

About Rimawari-kun

With the concept of ”support in a new form,” Rimawari-kun is a ”’supportive’ real estate crowdfunding platform” that allows people to invest from 10,000 yen per unit in real estate that contributes to society, revitalization of local communities, and supports someone’s dreams and challenges.

SYLA will continue to expand “Rimawari-kun” services to better meet the needs of its customers, while keeping in mind its concept of ”social contribution, regional development, and support for someone’s dreams and challenges.”

*Rimawari-kun is the No. 1 real estate crowdfunding service in Japan in terms of registered members.

FY6/2023_Market Survey of Real Estate Crowdfunding Service Member Registrations

Research organization: Japan Marketing Research Organization

Rimawari-kun website

https://rimawarikun.com/

SYLA Technologies Company Contact

Takeshi Fuchiwaki

Director, Chief Growth Officer

irpr@syla.jp